Active 2024 Hurricane Season Predicted

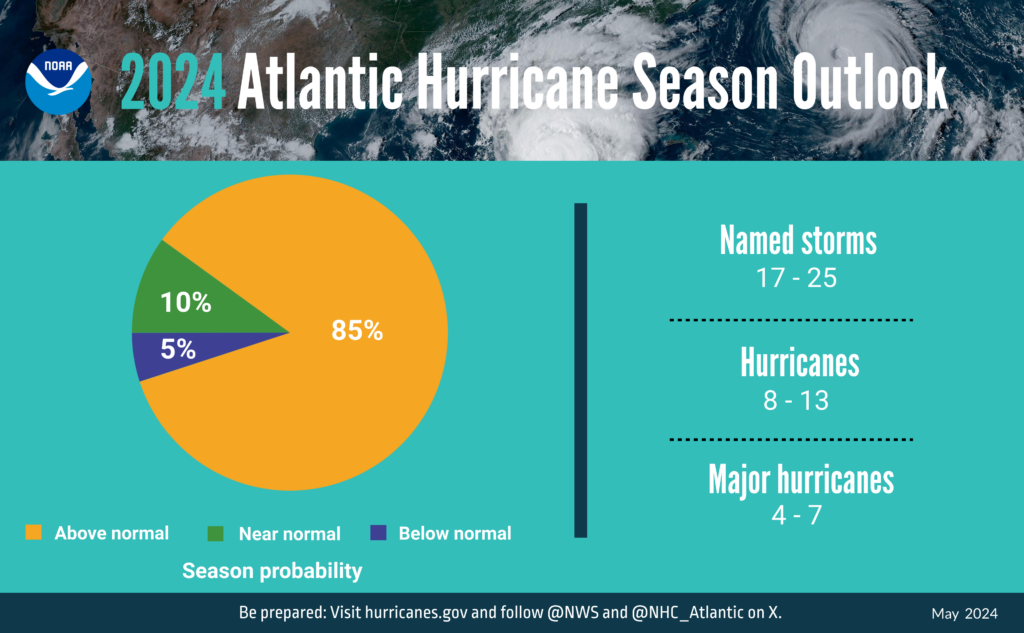

NOAA National Weather Service forecasters at the Climate Prediction Center predict above-normal hurricane activity in the Atlantic basin this year. NOAA’s outlook for the 2024 Atlantic hurricane season, which spans from June 1 to November 30, predicts an 85% chance of an above-normal season, a 10% chance of a near-normal season and a 5% chance of a below-normal season. With weather forecasters considering moving up the start of the hurricane season, and another above-average hurricane season predicted for 2024, you might ask yourself, “does my car insurance cover hurricanes?”

The Big Question: Does Car Insurance Cover Storm Damage?

Storm related damage to your car is typically covered under comprehensive car insurance. Georgia does not require that you carry comprehensive coverage on your car, so this is optional coverage. If you have comprehensive coverage, then you’re most likely covered for storm damage to your car. If you didn’t select this type of coverage, you’ll probably have to pay the repair costs out of pocket. To find out what type of coverage you have, connect with your insurance agent. They’ll be happy to walk you through your coverages.

A car insurance policy that consists only of Georgia’s minimum liability coverages wouldn’t be of any help if high winds tip a tree onto your car or floodwaters seep into your vehicle. That’s because bodily injury liability and property damage liability only cover others’ injuries and property damage from accidents you cause — they don’t offer any protection for your own vehicle. Liability insurance can play a role in helping you if someone is injured in a crash, but won’t likely help you if your car is damaged during a storm.

What to Do When You Discover Storm Damage to Your Car

Safety comes first when your vehicle has been damaged. Downed power lines can be a concern and you don’t want to tangle with electricity. Approach the car with caution and walk around to assess the damage. Take pictures as you go so you can document the car from top to bottom before any storm clean-up begins. Don’t forget to take pictures from the inside if the interior has been damaged, too. If your car is seriously damaged you shouldn’t drive or get into it. It’s not safe, and you may actually cause more harm. However, if the storm damage is relatively small or cosmetic, like roof or panel damage from a falling limb, you might be able to safely drive your car. But, in any situation, the best course of action is to connect with your insurance agent, send them pictures of the vehicle and damage and ask what your car insurance policy suggests.

Whether your vehicle has minor or major damage, don’t authorize any repairs until your insurance agent has given you the go-ahead.

Buy Coverage Before Storm Warnings Go Into Effect

The National Hurricane Center (NHC) says a hurricane or tropical storm warning is issued when weather conditions (sustained winds of 74 mph or higher for a hurricane or sustained winds of 39 to 73 mph for a tropical storm) are expected somewhere in the specified area within 36 hours. A storm watch is issued when these hurricane- or tropical-storm-force winds are possible within 48 hours.

This NHC information is significant because if a hurricane is forming, or already coming in your direction, and you want to buy comprehensive and collision coverage, you would need to do so before a tropical storm watch or warning goes into effect. Otherwise, you may be out of luck since insurers can place restrictions on changes to policies or new policies during a storm.

Bottom Line

If you have storm related body damage, Hollingsworth Auto can help. Call Hollingsworth Auto Service today at: 912.234.6651. We offer comprehensive auto body repair services to correct any dents, dings, or other damage caused by storms. However, if your vehicle has been damaged by flood waters, we recommend taking your vehicle to a dealer service center. Either way, check your policy sooner rather than later and be sure to talk to your insurance provider and know your coverage.